Hey there, guys! Let’s talk about budgeting. I know, I know, it’s not the most exciting topic, but trust me, it’s essential for achieving financial freedom. Imagine walking into a room where your confidence precedes you, not just because of your sharp suit, but because you’ve got your finances locked down. That’s the power of smart budgeting.

As a guy who’s been there, I’ve learned that creating a budget that works for your lifestyle is crucial for succeeding in all areas of life. It’s not just about saving money; it’s about living the life you want and reducing stress. Because let’s face it—your finances shouldn’t be a source of anxiety. It’s about gaining control and unlocking possibilities.

Mastering Your Money: The Core Steps

So, let’s dive in and explore the straightforward steps to create a budget that works for you, Mercer Wexley-style. We’ll transform this daunting task into a manageable, even empowering, process.

Step 1: Track Your Expenses Like a Financial Detective

The first, and arguably most critical, step is to meticulously track your expenses. This isn’t about judgment; it’s about illumination. You need to identify precisely where your hard-earned cash is going. Think of it as gathering intel for your financial mission.

You can use a budgeting app like Mint and Personal Capital, or simply keep a notebook to track every dollar spent. For example, take it from Dave, a 45-year-old accountant who landed his dream client after revamping his LinkedIn profile photo—getting his financial house in order was his next big win. He started by logging every coffee, every subscription, and every impulse buy.

Step 2: Categorize Your Spending: Needs vs. Wants

Once you have a clear picture of your spending, it’s time to categorize. This is where you differentiate between essential expenses (needs) and discretionary spending (wants). Needs are your non-negotiables: rent or mortgage payments, utilities, groceries, insurance premiums, and essential transportation costs.

Wants, on the other hand, are those enjoyable but non-essential items: dining out, entertainment, hobbies, the latest gadget, or that premium subscription. Understanding this distinction is fundamental to making informed decisions about your money. This clarity allows you to prioritize effectively.

Step 3: Define Your Financial Goals: What’s Your ‘Why’?

Setting Your Financial Compass

Now that you’ve categorized your expenses, it’s time to set concrete financial goals. What are you working towards? This could be anything from saving for a down payment on a house, paying off significant debt (student loans, credit cards), building an emergency fund, investing for retirement, or planning that dream vacation.

Having clear, measurable goals provides motivation and a tangible target. For instance, aiming to save $5,000 for a down payment in 12 months is more actionable than simply wanting to “save more.” Your future self will thank you for setting these ambitious yet achievable milestones.

Step 4: Craft Your Budget Plan: The Blueprint for Success

With your financial goals firmly in sight, you can now create a budget plan. This plan is your financial roadmap, outlining projected income against your categorized expenses. Be realistic and honest here.

It’s crucial to include a buffer for unexpected expenses – life happens! This contingency fund is your financial safety net. For example, if your car breaks down or you have an unexpected medical bill, having this buffer prevents derailing your entire budget. A well-structured plan offers peace of mind.

Step 5: Monitor and Adjust: The Ongoing Refinement

Staying on Track and Thriving

Finally, and this is key, you must monitor your budget regularly and make adjustments as needed. Your financial situation, income, and expenses can change, so your budget needs to be a living document. Review your spending against your plan weekly or monthly.

Did you overspend in one category? Identify why and adjust another category to compensate. Perhaps you found a cheaper alternative for a recurring expense. This continuous monitoring and adjustment process ensures you stay on track and progressively move closer to achieving your financial goals. Consequently, you remain in control.

Elevating Your Financial Game: Additional Strategies

Prioritize Needs Over Wants: The Foundational Principle

This is a core tenet of effective budgeting. Before allocating funds to discretionary items, ensure all your essential needs are met. This principle helps prevent overspending on non-essentials when critical obligations loom. It’s about building a solid foundation before adding the decorative elements.

Conquer Impulse Purchases: The Art of Delayed Gratification

Impulse purchases can be budget killers. Before making an unplanned buy, implement a waiting period—24 hours, 48 hours, or even a week for larger items. Often, the urge will pass, and you’ll realize you didn’t truly need it. This simple hack can save you a surprising amount of money.

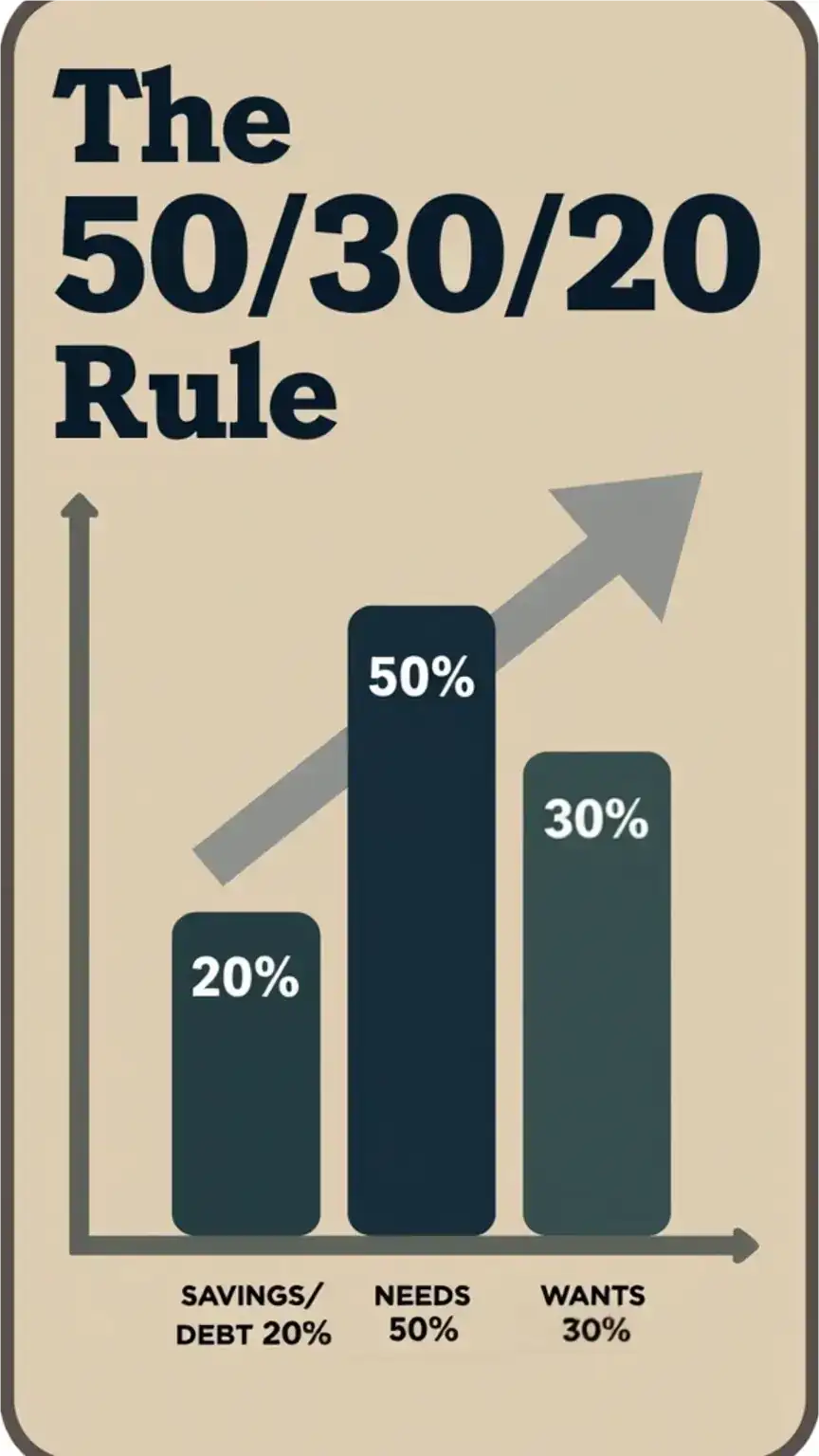

Embrace the 50/30/20 Rule: A Balanced Approach

Consider adopting the popular 50/30/20 rule:

- 50% for Needs: Allocate half of your after-tax income to essential expenses like housing, utilities, food, and transportation.

- 30% for Wants: Dedicate 30% to discretionary spending, including entertainment, dining out, hobbies, and personal care.

- 20% for Savings and Debt Repayment: This crucial portion should go towards building savings, investing, and paying down debt beyond minimum payments.

This guideline offers a straightforward framework for allocating your income, promoting balance and financial health. Furthermore, it’s adaptable to various income levels.

Automate Your Savings: Set It and Forget It

Make saving effortless by automating your savings. Set up automatic transfers from your checking account to your savings or investment accounts on payday. This “pay yourself first” strategy ensures you consistently build wealth without having to actively think about it. Consequently, your savings grow predictably.

Essential Tools and Resources for Your Journey

To aid your budgeting efforts, several excellent tools and resources are available. These can simplify tracking, analysis, and planning, making your financial journey smoother.

- Mint: This popular budgeting app automatically tracks your expenses by linking to your bank accounts and credit cards. Furthermore, it provides personalized budgeting recommendations and alerts you to upcoming bills. It’s a fantastic digital assistant for managing your money.

- Personal Capital: Beyond budgeting, Personal Capital offers comprehensive financial management. It helps you track your income and expenses, monitor your investments, and provides valuable insights and advice for growing your wealth. It’s ideal for those looking for a holistic financial picture.

- Dave Ramsey’s Budgeting Basics: For a more guided approach, Dave Ramsey offers extensive resources on budgeting and financial planning. His methods emphasize debt reduction and building wealth through disciplined saving. His book, The Total Money Makeover, is a great starting point (Amazon affiliate link).

Your Path to Financial Freedom Starts Now

Creating a budget that aligns with your lifestyle isn’t a one-time task; it’s an ongoing, dynamic process. By diligently following these steps, staying committed, and utilizing the right tools, you can achieve financial freedom and live the life you truly desire. It’s about gaining control, reducing stress, and unlocking your potential.

Ready to own your image, starting with your finances? Begin by tracking your expenses diligently and setting clear financial goals. Share your #StyleUpgrade and your budgeting wins on Pinterest or your favorite socials!

What budgeting tips do you swear by? Share your experiences and advice on Pinterest or your favorite socials!